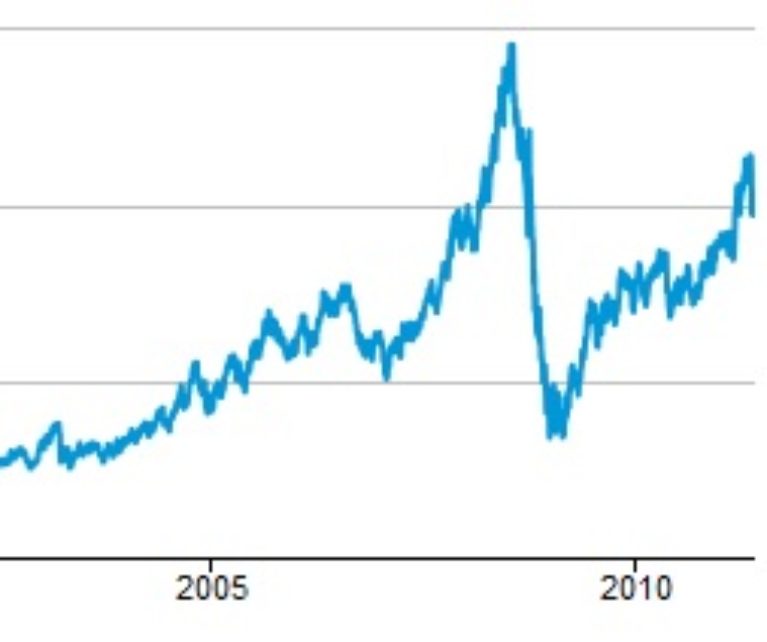

Oil and gas prices are world commodities that are subject to big price swings. The trend for pricing for these commodities in 14 of the past 15 years has been up. In the past year prices have been substantially cut. The reasons for the price cut have to do for the most part with increased supply and a stronger dollar. The US has been producing more oil and gas, and the Saudis have increased supply to maintain market share. The question is, will this shorter term trend continue, or will we go back to the long term trend of higher pricing?

The underpinnings of the price cut are not long term. Dollar strength can reverse with a weakening economy after the elections. Already drilling budgets are being cut way back and the oil sector everywhere is hurting. Cutbacks in drilling will lead to lower supplies more quickly than in the past because the types of wells being drilled today, in shale, are shorter lived. Also, we all know that unrest in the Middle East leads to disruption in supplies. That whole area, and the other oil producing areas as well are not politically and economically sound. The list is long: Libya, Nigeria, Russia, Venezuela, and the whole of the Middle East are facing tumultuous forces that can result in decreased supplies of oil.

An investment in a heating system is substantial and long-lived. Do you want to lock in your heating future to a fuel just because it is cheap today? Since their introduction in the mid 90s, wood pellets have always been priced less than oil and propane, usually substantially so. So in the long run, you can expect to save much more with an investment in a wood pellet boiler.